The Ultimate Guide to WOO Network: The Crypto Platform You Can't Afford to Ignore

WOO Network is your one-stop platform for CEX, DEX, cross-chain swap and yield farming

GM anon!

What are the most important functions that any crypto anon would need in the crypto world?

It has to be trading for profits, farming for yields, and managing assets across multiple chains seamlessly.

What if I told you there's a platform designed to meet all of these requirements, offering secure solutions paired with an exceptional user experience? Intrigued?

Join me today as we explore the WOO Network ecosystem, a hidden gem that we believe is significantly undervalued.

Whether you're new to the space or a seasoned trader, you'll want to learn what sets WOO Network apart in the ever-evolving world of web3.

Overview of WOO Network

WOO Network isn't just another player in the crypto landscape; it's a comprehensive platform that seamlessly integrates a Centralized Exchange (CEX), a Decentralized Exchange (DEX), cross-chain swaps, and yield farming opportunities.

While most centralized exchanges hesitate to venture into the decentralized space, the WOO team has fearlessly expanded their footprint into the on-chain ecosystem. So, what makes this strategic move exceptional?

First and foremost, the on-chain capabilities of WOO Network dramatically enhance the intrinsic value of the $WOO token. Unlike many exchange tokens that serve a limited purpose, $WOO is endowed with real utilities and demand, which we will explore in detail later on.

Second, by maintaining an on-chain presence, WOO Network stays at the forefront of the decentralized landscape. This proximity to decentralized innovation allows the team to identify emerging narratives and trends, enabling them to respond swiftly to market movements.

Finally, WOO Network is singularly focused on one critical mission: to provide deep liquidity across the web3 ecosystem. This enables participants to easily navigate between centralized and decentralized platforms, thus enriching the entire web3 landscape.

Now, let's dive deeper into the robust offerings of the WOO Network.

WOO X

Safety First: Merkle Tree Proof-of-Reserve

When it comes to centralized exchanges, WOO X sets a new standard, prioritizing not just trading experience, commission fees, or liquidity, but something far more fundamental – proof of reserve.

WOO X has a live proof-of-reserve dashboard that displays the current assets and liabilities.

For instance, in this screenshot, with $69.5M in assets and $53.1M owed to depositors, a reserve ratio of 131% ensures more than enough liquidity to meet simultaneous withdrawal demands.

The custody ratio on the right hand side represents the assets that are kept under custody as percentage of total user deposits.

With these proofs, anyone can ensure that their assets are secured on WOO X.

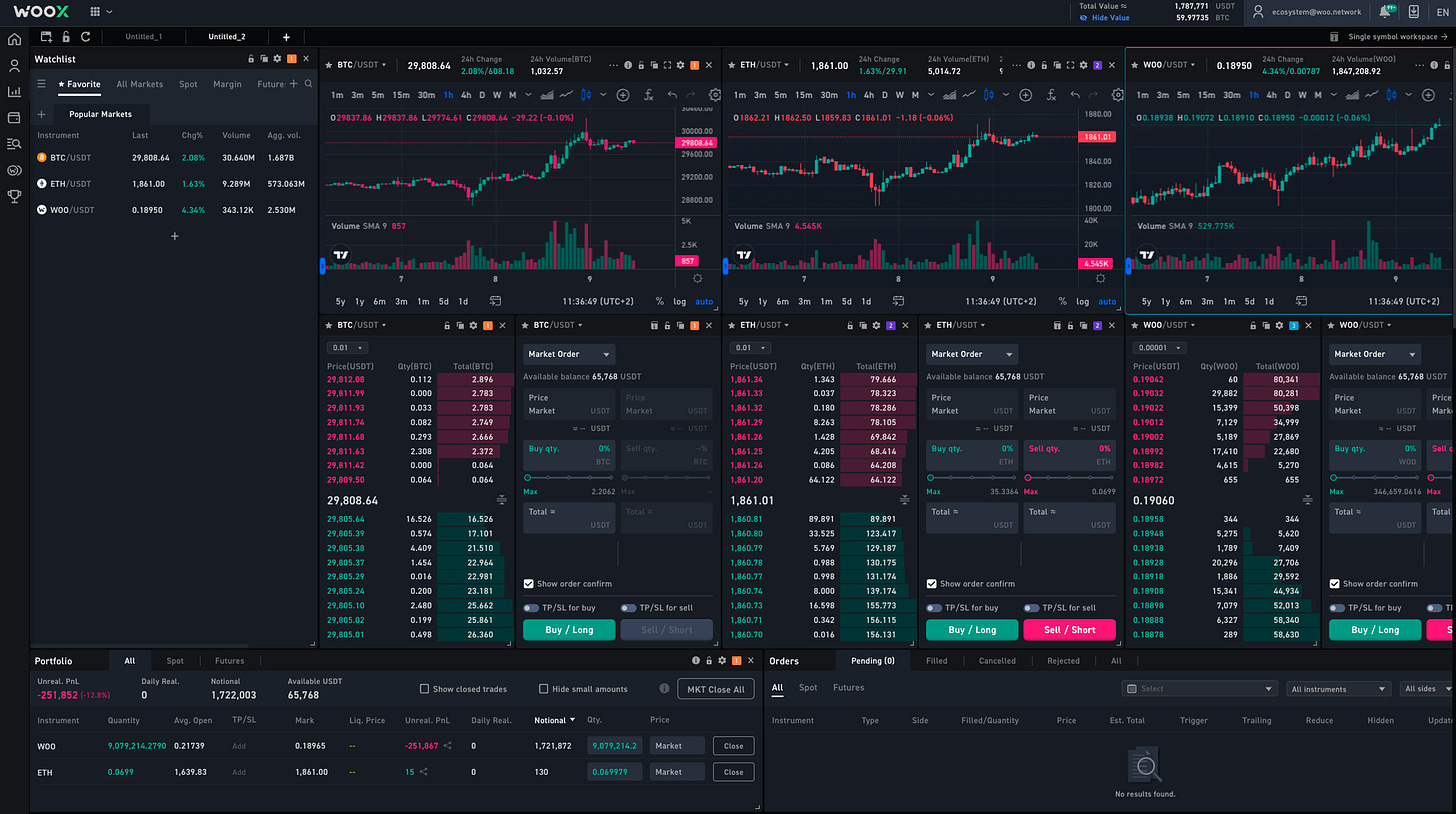

Great trading experience

WOO X offers great trading experience with customizable trading view. The trading page is intuitive and easy to understand.

For users that don’t really require customization, there’s also a default single asset setup that allows users to trade easily.

Favorable fee structure

Stake $WOO tokens to significantly reduce trading fees.

For most of the popular trading pair, such as BTC/USDT and ETH/USDT, these will fall into the Zero Fee Zone, requiring only 1,800 staked $WOO tokens for zero fees.

For other trading pairs, it will require 500K staked $WOO tokens.

Launchpad: coming soon

WOO X is also expecting to roll out their launchpad, which would open deal access to those who stake $WOO token, so stay tuned 👀

WOOFi

WOOFi stands as a bold innovation crafted by the WOO team. It's more than just a DEX; it's a holistic platform that embraces cross-chain swaps, yield farming, and an orderbook DEX. Let's explore the advanced features that make WOOFi a remarkable solution in the DeFi landscape:

sPMM algorithm: WOOFi's proprietary Synthetic Proactive Market Making (sPMM) algorithm enables deep liquidity without the necessity for extensive funds in the liquidity pool. This algorithm mimics the centralized exchange's liquidity provision, providing more efficient capital usage.

Cross-chain swap: With integration of LayerZero's cross-chain messaging and Stargate's bridge liquidity, WOOFi makes cross-chain swaps as simple as a single click. It currently connects to 11 major chains, facilitating seamless asset movement across a broad ecosystem.

Yield Opportunities: Users can deposit assets into sPMM pools, earning yield on their provided liquidity.

WOOFi DEX: Built on the NEAR Protocol, WOOFi DEX leverages WOO Network’s liquidity with Orderly Network’s decentralized exchange protocol, offering an orderbook trading experience typically found in centralized exchanges.

Competition

In the bustling arena of decentralized exchanges, where giants like Uniswap and Curve loom large, WOOFi has carved a unique niche. Its focus on cross-chain DEX and superior user experience make it a leader in its sub-sector.

According to DefiLlama, WOOFi ranks #28 in cumulative volume across all DEXs and is among the top 3 in cross-chain DEX. With a daily volume of around US$20M, it's consistently among the top 20 protocols.

WOOFi represents an evolution in decentralized trading, taking strides towards efficiency, usability, and adaptability. Its features set it apart, and its innovative approach may well redefine how we interact with decentralized financial products.

$WOO token

The $WOO token acts as a crucial element within the WOO Network, weaving together the ecosystem with multiple applications and driving engagement. Here's an exploration of the token's distribution, supply management, and its diversified utility across the network.

Distribution

The following table highlights the evolution of $WOO's distribution, detailing changes from its initial allocation to a strategic revamp carried out in January 2023:

This distribution reform came as a response to community concerns regarding inflation. The WOO team initiated a ~24% burn of the total supply, particularly targeting tokens earlier allocated to WOO Ventures, the insurance fund, and DAO treasury.

Supply: vesting and inflation

As of January 2023, during the token overhaul, 73% of the $WOO tokens were already in circulation (now 77% according to CoinGecko).

Ecosystem Rewards: 545M (29%) were moved to a time-locked smart contract, set to be vested linearly over 5 years.

Team, Advisors, and Investors: 14% are vesting over 3.5 years, with an additional 13% withheld for future allocations, entering a 3.5-year vesting period once allocated.

This methodical approach to vesting ensures a balanced supply and maintains low inflation, aligning the long-term interests of the ecosystem.

Demand: utilities

The $WOO token finds various utilities across the WOO Network, including:

Staking on WOO X: Stakers receive $WOO rewards at around 4-5% APY and enjoy zero fees, as previously outlined in the WOO X section.

Staking on WOOFi: Following a model inspired by GMX, staking on WOOFi yields USDC rewards drawn from the WOOFi swap fee pool. 80% of these rewards are gathered on Arbitrum every Thursday and distributed to $WOO stakers.

Future Developments: The team has hinted at forthcoming opportunities, such as staking for launchpad allocation and access to institutional yield strategies, so stay tuned 👀

Final thoughts

As we mentioned in the beginning, WOO Network’s vision of providing deep liquidity across centralized and decentralized platform set them apart.

With WOO X being a safe CEX and having a clean record (unlike many other CEX who are facing regulatory scrutiny), WOOFi offering a compelling on-chain solution covering cross-chain swap, yield farming and DEX, and WOO token enabled with multiple use cases, we believe WOO Network is well positioned to ride along with the next bull run.